The record rains earlier this week led to a curious situation where a block of flats was evacuated because of a flood. You might think that a flood wouldn’t present a big risk to most people living in a tower block, as they’d still be well above the water-line. But the rush of water was so strong that it was destroying the foundations of the building, threatening it with collapse.

The truth is like that – it can be catastrophic to weak edifices if it flows strongly enough.

Jacob Rees-Mogg was on BBC Question Time last night. Urbane, self-assured, articulate and mannered, while his exceptionally ‘posh’ accent might set some people’s teeth on edge, he’s certainly one of the better options the Tories have when they want a talking head to represent them in the media.

He can be very convincing, too, as he delivers his lines with eloquent conviction. Of course, that doesn’t mean he’s not talking tripe! And last night, he certainly was.

Here are some of his main points on taxation and the economy – along with what he wasn’t telling you:

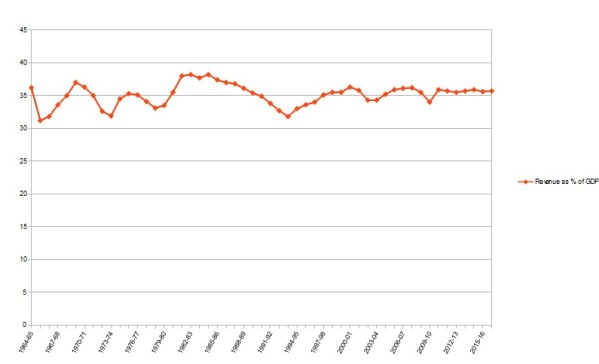

Tax revenue never goes above 38% of GDP

JRM’s contribution to the discussion on taxation began by observing that tax revenues since the 70s have ‘almost never’ gone over 38% of GDP, no matter what the top rate of tax has been, so there’s no point in increasing the top rate of tax. He wasn’t lying, insofar as his statistic was concerned:

What he didn’t mention is that under the current tax regime, projected tax revenue for the current financial year is only 35.5% of expected GDP. Since that’s an expected figure rather than a real one, let’s look at the 2011/12 year instead: last year, government revenues from income tax were £550.6 billion, or 35.7% of GDP of £1.542 trillion.

The difference between 38% and 35.7% might not seem like much. But if the government had taxed in order to achieve the ‘magic’ 38% figure, it would have generated an additional tax take of £35.47 billion. Or, to put that into terms that make concrete sense: enough to make the welfare cuts so far of £10bn AND the targeted NHS cuts of £20bn completely unnecessary AND to cover the appr. £4bn shortfall in public sector pensions.

And if this year’s projections bear out, the difference will be even higher. It’s usually a lot more sensible to look at what a Tory doesn’t say than what she/he does!

Revenue always 38% of GDP means no point raising top tax rates?

The other thing that Rees-Mogg’s 38% figure tells you is that if increasing top tax rates don’t increase revenue, then it means that the system is ‘leaking’ – through loopholes that are exploited by the rich to avoid paying, leading to the ‘never more than 38%’ situation. JRM would like you to believe that this means there’s no point in increasing the rates and we’d all be better served by lowering the rates so that the rich feel like paying.

What absolute nonsense. If your bathtub’s leaking, you don’t stop using it. You plug the leaks. Then every drop you put in makes your bath deeper and saves you money. Without intending to, JRM told us last night that we need a tax system that is simplified – not (as the occasional right-winger who comments on my blog would say) so that you can lower the top tax rate and maintain revenues, but so that you can tax at whatever rate a government needs to, and increase revenue accordingly. If we make our tax system simpler – primarily by eliminating deductions, there is no shortage of cash, and no need to cut.

Here’s another way of looking at the same thing:

This table shows incomes of various bands of the population in 2008. At the time, the top rate of tax was 45%. The top 1% had an average income of £155,832 and paid average tax of £49,477 – an effective rate of 31.7%. Of course, everyone gets a tax allowance they can earn before playing tax, but as you earn more, the rate you should pay gets closer and closer to the nominal top tax rate.

If the same 421,000 people had been unable to exploit loopholes to reduce their tax bill so that they had actually paid close to 45%, the tax take in 2008 would have been about £8.7 billion higher! And that’s before we even start considering increasing the tax rate.

The top 1% pay their fair share: 26% of tax revenues

Again, Rees-Mogg’s figures are more or less ok – though it depends where you look. However, for the purposes of this post let’s assume they’re correct. JRM defended the rich (he’s a Tory, so hardly surprising) by saying that the top 1% of earners in the UK earn 13% of the country’s total income, but contribute 26% of tax revenue. He used this figures to state emphatically that the rich ‘pay their fair share‘..

If those figures meant much in isolation, he might be right. But do they?

In 1997, the top 1% contributed 21% of the UK’s total income tax revenue. So you might think they’re paying an even bigger share now than they used to. That would be true if they were earning about the same in real terms or as a proportion of national income.

However, this is far from the case. A BBC website article at the beginning of this year analysed the increase in UK income inequality from 1997 to 2007. It showed that the average income of the top 1% of UK earners increased from £187,989 to £301,325 – an increase of just over 60% (income of the top 0.1% almost doubled). Since inequality has only increased since 2007, we can safely assume that the difference is much greater 5 years later. During the same period, average incomes for the bottom 90% increased by only 17.6% – and for the lowest earners by far less.

The increase in the tax contribution by the top 1% since 1997, from 21% to 26% means that their contribution is around 23% higher, relative to what they were paying in 1997 – far less than the increase of at least 60% (and probably much more) in their incomes. This means that the wealthiest are now paying substantially less toward our national upkeep than they were 15 years ago, relative to their wealth.

They’ll work less hard or just leave!

Of course, Rees-Mogg had to roll out this old chestnut again. But it’s such nonsense I won’t take much time over it here. If a wealthy person doesn’t think living in a decent, fair, stable society is worth paying for, then let them leave. The laws of supply and demand mean others will take their place – and those will be people who are a bit less greedy and more less unwilling to pay the ‘rent‘ that is needed to make and keep the country a good place to live for everyone.

It’s not that difficult to find the holes in the Tories’ arguments. They’re big enough to drive a bus through, and you only need to look a little bit carefully to find them. The problem is, many don’t bother to look – and so get fooled and buy into the Big (HUGE!) Lies. So if you’ve read this far, you’re more informed that most – and bear a responsibility to tell others so the word spreads, the foundations of the Tory lies are undermined and their whole house of cards comes crashing down. Just like a weak tower block in a flood.

Hi Steve,

Hope you’re well? By the way on a random note for some reason I always read the name of your blog as ‘skywalker’ my mind is clearly losing it and adding extra letters in things!

Anyway just wanted to comment on a couple of bits…

“What he didn’t mention is that under the current tax regime, projected tax revenue for the current financial year is only 35.5% of expected GDP. Since that’s an expected figure rather than a real one, let’s look at the 2011/12 year instead: last year, government revenues from income tax were £550.6 billion, or 35.7% of GDP of £1.542 trillion.

The difference between 38% and 35.7% might not seem like much. But if the government had taxed in order to achieve the ‘magic’ 38% figure, it would have generated an additional tax take of £35.47 billion. Or, to put that into terms that make concrete sense: enough to make the welfare cuts so far of £10bn AND the targeted NHS cuts of £20bn completely unnecessary AND to cover the appr. £4bn shortfall in public sector pensions.”

While no doubt it’s true that if we did have tax take at 38% of gdp, you’ll notice from your own graph that that percentage doesn’t correlate to when tax is highest, indeed in the tax and spend years of the 60’s and 70’s it’s mostly pretty poor while under Mrs.Thatcher with lower taxes it’s generally higher. The figure actually more closely follows the state of the economy than the current tax rates, so it’s no real surprise that right now it’s down from where it has been.

“This table shows incomes of various bands of the population in 2008. At the time, the top rate of tax was 45%. The top 1% had an average income of £155,832 and paid average tax of £49,477 – an effective rate of 31.7%. Of course, everyone gets a tax allowance they can earn before playing tax, but as you earn more, the rate you should pay gets closer and closer to the nominal top tax rate.”

The top rate of tax in the UK only kicks in at £150,000 so the tax paid on the average income should be around that level, there’s no obvious loopholes being exploited in that figure.

Hi Chris. I’m well thanks – trust you are too!

Working out the tax applicable to each income band, for someone on exactly the mean income of the top 1% the effective tax rate should be at least 35% – more in reality, since it’s hard to imagine people on such incomes not receiving substantial benefits in kind too. So I think the point stands.

When you look at the figures for the top 0.1% it’s even clearer – the effective rate at the mean should be a little over 43% and they paid on average about 35%.

And those figures are just on direct income, not on shares etc that are more likely to to be involved for the top 1%, not to mention offshored income etc that deflates the apparent income figure.

Tired now so going to stop looking at numbers for a bit!