On Newsnight last Wednesday, a very sharp old lady nailed Conservative minister David Willetts during a discussion on pension reforms by challenging the idea that we can’t afford to maintain the welfare state today when we could afford to construct it from scratch in the immediate, crushingly-indebted aftermath of World War II. It’s a question I’ve heard before – and one I’ve raised on many occasions. But hearing this game old woman raise it with such fire set me thinking even harder about it. Being weird that way – no, being OUTRAGED enough – I’ve spent most of the day and evening into the early hours researching, considering and assessing that challenge and the facts that lie behind it, and behind the counter-argument.

Willetts – far from the most odious of the current crop of Tory ministers, hemmed and hawed and fudged a response, but really had no good answer. Eventually he had to fall back on the old Conservative red herring that ‘there is no magic money tree’, so reforms are inevitable.

The ‘no magic money tree’ cliché is a key part of the Tory narrative of the current economic situation and the reasons for it, because it allows Tories to ridicule any claim that there is an alternative to cuts. The story (and it is just that, not a factual analysis) that the Conservatives want us to believe states that welfare costs – bloated by ‘benefit scroungers’ and an increasingly ageing population – are ‘out of control’ and that we can’t allow things to continue as they are, so various ‘reforms’ (for which read: cuts) are unavoidable. There is no ‘magic money tree’ to pay for these things we’ve enjoyed as of right up to now, so we have to be prepared to see them decimated.

We’ll return to that fishy falsehood presently. But first let’s look at the past and current contexts and see what’s really happening – and how we really stand compared to that famous and gilded period 70-odd years ago when the political giant Aneurin Bevan constructed a system that aimed to provide for the British people ‘from the cradle to the grave’.

Public debt

A major part of the government’s yarn about the unaffordability of our welfare state is that our national debt is out of control. Various versions of ‘record deficits’, ‘debt worse than Greece’ (it isn’t) etc are misleadingly used to create the impression that the UK is circling the drain in a whirlpool of runaway debt, that things have reached a level that can’t possibly be sustained.

Fact trumps fiction. So here’s a graph showing the UK’s national debt, as a percentage of GDP, since 1950-2010:

Paints an interesting picture, doesn’t it? The government likes to point at recent increases in debt to justify the ‘unaffordability’ of the welfare state. But in the days when the UK was constructing it, saddled by vast costs of fighting a world war, our public debt was more than three times as high, at almost 200% of GDP.

And guess what? As the welfare state was built from nothing, adding major new categories of public spending, our national debt fell rapidly. In a period of 25 years, during which the welfare state was extended, public debt fell from almost 200% to just over 40% of GDP. And just to head off (again) any Tory claims that the debt went out of control due to Labour economic mismanagement, please look again and see that it remained broadly the same through the long years of Thatcher-Major, and actually came down under New Labour until the global financial crisis pushed GDP down and unemployment up:

As this graph shows, debt is often higher under a Conservative government, and for most of New Labour’s term in office, debt was brought down. So much for mismanagement.

Here’s another important piece of the context. This graph shows UK welfare spending since 1950:

If you compare the dates in this graph and the preceding one, you can see that many of the times when the UK’s national debt fell coincided with increases in welfare spending (including under Thatcher). Welfare spending up to the end of the last Labour term were very much in line with historic norms, in spite of the increase in NHS & education spending over the last few years of Labour government.

So, it’s clear that welfare costs are really not the key factor in the UK’s debt problems or otherwise. No – something else is going on, some other dynamic is at work in the current deficit and debt situation. Let’s take a look at some more figures that will give us an idea what’s really causing our current troubles, and then we can suggest what really needs to change in order to resolve them.

From wages to corporate profits

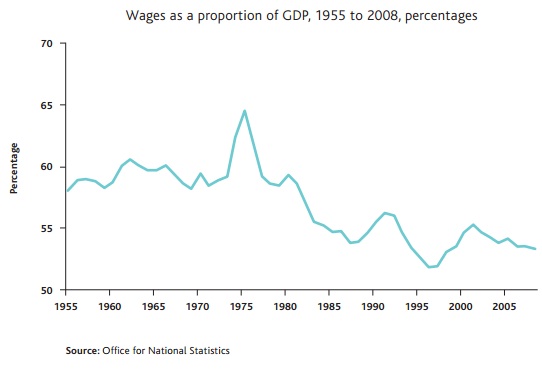

Here’s a graph showing the percentage of GDP that was represented by wages – this time since 1955:

Through the 60s and into the mid-70s, wages grew as a percentage of GDP. But as soon as Thatcher came to power, she instituted a dramatic shift of income away from workers and into company coffers:

And remember, this graph is based on reported profits. Companies have numerous accounting tricks to minimise the amount of profit that is reported for tax purposes, so the real situation would be far more pronounced. But even based on what they admit to, we can see a substantial transfer of wealth from ordinary people, who generally pay full tax on what they earn, to companies, who generally don’t. Which leads us to the next key factor:

Corporate tax rates & avoidance

In terms of the national debt, a swing of income from private individuals to company profits, while unfair, wouldn’t pose a problem per se – as long as companies paid taxes at similar rates to individuals. Unfortunately, even the headline rate of corporation tax is far lower than what individuals would pay on the same overall sums. And it’s falling. Chancellor George Osborne announced, in his last budget, that corporation tax would fall from April 2013, and then fall even further in the following budget. Supposedly, this is to stimulate growth & employment, but as I highlighted in an earlier analysis, there is no link between low company taxes and economic or employment growth. The next graph shows the trend in corporation taxes over the past few years:

Now, it’s important to bear in mind that because of the various accounting tricks the ‘effective tax rates’ that companies report are significantly higher than what they’re really paying. So the real situation is even worse – companies use accounting tricks to lower their taxable profits, then use more to appear to be paying more tax than they are. And then they have yet more tricks to reduce their real tax rates even further. Remember the scandal last year as Barclays paid only 1% tax on its massive profits?

Now, to be absolutely frank, this graph from the Socialist Worker site doesn’t quite compare apples with apples, as it compares the increase in profits of a select group of companies with the tax-paid trend of UK companies generally. But that only skews the data slightly – and it’s still an extremely telling and eloquent picture of the part of the problem I’ve been describing:

This massive switch of income to company coffers, combined with lower rates of corporation tax and then the aggressive avoidance even of those lower rates, has led to an enormous tilt in the balance of national wealth from the public purse to the corporate purse:

As a result, private companies are sitting on unused balances of appr. £700 billion – at a time when the economy is in recession and the government is expecting the ordinary member of the public to bear all the pain.

Unrealistic profit expectations

Over the past 30 or so years, the neoliberal ‘reforms’ and deregulation of Thatcher & Reagan have created a massively inflated profit demand among investors. Instead of a reasonable expectation of a steady and sustainable profit, investors have expected large – and constantly growing – rates of return:

As you can see from the graph, the increased importance of the financial sector to the UK economy, with its even more inflated profits, have served to overheat investor expectations. These expectations have pressured company executives to cut every possible penny of cost and to avoid every possible penny of tax. Unsustainably so – but every CEO is going to be most immediately concerned with his own income and security in the short term. All of which is massively damaging to the UK economy, and fuels the next problem:

The rich get richer

As investor greed has grown, so have the rewards for those who are able to meet their expectations in the short term. This has fuelled a massive acceleration in the pay of a very small number of people who claim to be able to sustain the unsustainable: a continual increase in profitability and a continual reduction in costs. This sucks income from the lower earners and inflates the wealth of the few who run companies or own them – and these people, just like big corporations, can afford to pay accountants to exploit every available loophole to reduce the percentage of tax they pay. This further enriches those few people (and their accountants!), while reducing state income to provide services and security for the many.

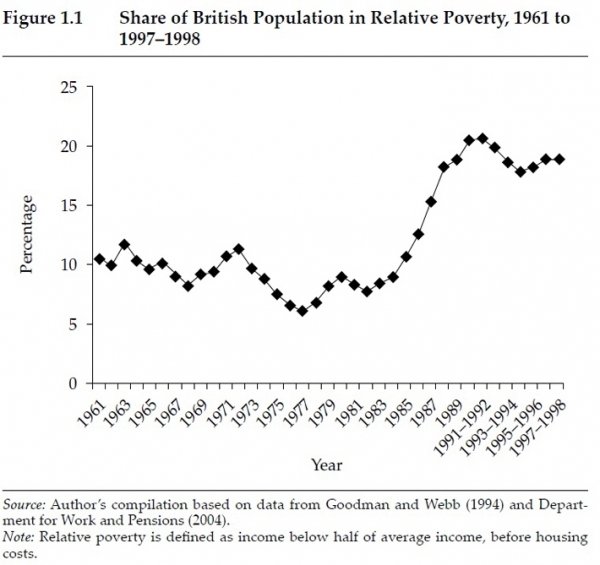

The poor get poorer

The massive rises in income inequality – again starting with Thatcher’s accession to power – have fuelled a simultaneous rise in poverty in the UK. As poorer people – by definition – have to spend more of what they receive simply in order to survive, taking money out of their pockets reduces the government’s take in terms of income tax and VAT. This removes money from the public purse that should be available to pay – easily – for the social state of which Britain used to be rightly proud.

I hope I’ve painted a very clear picture for you – one that unequivocally shows just how deceptive the government’s ‘narrative’ about the current ‘crisis’ is. And, as I’ve spent all day on this and it’s now very late, I hope I’ll remain lucid enough to be equally clear in drawing the right conclusions from all the evidence!

Osborne and co are very keen on talking about the UK’s ‘structural deficit’ as a justification for the ideological changes they want to push through – and are making. It’s an absolute lie. There is no structural deficit – but there IS a structural problem.

It’s not a problem of Labour profligacy. It’s not a problem of scroungers vs strivers, of an ageing population or of an out-of-control burden on the UK public purse. It’s a problem of a systematic and continuing transfer of wealth and income from the many who would pay tax on it and spend most of the rest into the pockets of a few who will avoid taxes in every conceivable way and keep as much of it for themselves as (in)humanly possible.

It’s a very different one from the picture that our ‘leaders’ would like to paint for us. I said I’d come back to the enormous red herring of the line that there is ‘no magic money tree’. It’s rare for me to agree with the Tories – but they’re absolutely right. There is no magic money tree.

But there is something very concrete and even more important: a massive pot of gold that has been stored up through greed and deception by a few wealthy individuals and some extremely greedy and powerful corporate interests. More than enough to to provide for the needs of ordinary people for generations to come – and what we need are not cuts to public staff and services, not increased retirement ages and pension contributions, and not an acceptance of the supposed inevitability of the destruction of Bevan’s ‘cradle to grave’ ambition.

No, what we need is a series of bold, unapologetic measures to take back the wealth that the few have taken by stealth and deception from the many; to enforce a proper assessment of company profit and a fair taxation of it; a dramatic restructuring of ethos and expectation in our corporate and financial sectors toward levels of profit and growth that are sustainable and a level of labour cost that sustains and enhances our social structure; and an end to the gutless, witless surrender of our democracy to private and corporate interests. Then it will not only be affordable to maintain our social protection – it will be easily so.

These measures will never, under any circumstances, be implemented by the current, craven government that is in thrall to its paymasters and its redundant ideology.

Until we can get rid of it, we need to inform and equip ourselves to resist its measures to the utmost extent. And then, when we have an opportunity to do so, we must vote them not only out of power but out of existence as a political force – and then, without embarrassment (since they’re trying to do the same), make whatever electoral reforms are necessary to ensure that they never take power again.

You could have added a diagram to show how private debt grew exponentially from 1971-2007 with a few little bumps. That this was a major cause of the current depression. That a private sector saturated with debt is not going to invest in sufficient quantities to create growth. That lending is so risky that banks are unlikely to want to lend anyway, as their customers hover on the edge of bankruptcy. The combination means that relying on private sector to lead growth in delusional.

It also means that austerity is only going reduce demand. The only way to see this positively is that it will bring down private debt more quickly as bankruptcy means debts are written off. In fact austerity is a code word for shrinking the state. The worry is that Labour are only arguing about the pace of austerity cuts, not the ideological basis behind them! They’re bought into the myths about public debt. So who do we vote for?

Superb blog. You should lobby the Labour Party relentlessly with this, in the hope there are still principled MPs there. The Tories need to be obliterated once and for all. We can all hope Murdoch is on the way out and will not be able to command the slavishly anti-state ‘pro-business’ rhetoric amongst the ignorant he once did.

Its no secret, you can easily find the details of the top UK earners.

And their personal wealth this last year alone runs in the billions EACH!

This is less then 0.001% of the UK population cradling the major percentage of its wealth!

And then they raise the tax for people who earn £30k!

Reforms are not needed, riots on the houses of parliament on the other hand would be a good show of the fact that their many millions will never be enough to protect them from the people they rob.

Thank you so much for taking the time to write this brilliant piece. The tories aim would always be to decimate the state, deficit or not. This propaganda they’ve been spouting about the deficit just makes it easier for them to slash and burn the public sector and people are falling for this. Thanks again.

Very good, keep highlighting this stuff

Could someone please please explain to me how a job centre can have 3000 job vacancies and 300 registered as long term unemployed. Yet some people can get two jobs just to help ends meet. The welfare state was created to assist until full health was regained so that you could return to work. Money was given to the unemployed so they could just cover the basics. I work 5 or six days a week and my basic is 26k. If I stayed in bed I could receive the same. Well now that it’s capped anyway, before I could of received more to stay at home. I know this is going to fall on deaf ears and I will only get abuse back but how can it be a fair state if I die early through over work for less money than someone who doesn’t work?

You won’t get any abuse from me, even if we disagree. I don’t have statistics, but from my own experience of job centres, the reasons would break down more or less as follows:

1. You mention 3k vacancies and 300 ‘long-term’ unemployed. Most people coming out of a job probably manage to find a new one fairly fast, while there will be a pool of low-skilled/unskilled people who form the long-term numbers. In reality, there are about 80 people going for every vacancy (I reference this in another post), so 79 are always going to be disappointed. It will be a rare job-centre indeed that has more vacancies than unemployed people.

2. Part-time/low-wage – people need to be able to make a living wage to come off benefits. Many jobs don’t offer one and are only suitable for spouses etc looking for ‘top-up’ income. Read the analysis I did on the June ONS employment stats – full-time jobs are being lost rapidly while part-time job numbers are growing. Could you afford to work part-time? I couldn’t.

3. ‘Zero hours’ contracts. More and more jobs are being offered on this basis. A person has to come off unemployment benefit to take it, but isn’t guaranteed any hours at all – they’re agreeing to take whatever’s given to them. Again, not a realistic proposition for a family’s primary breadwinner.

4. Self-employment. A lot of ‘jobs’ advertised are actually on a self-employed basis with no guaranteed income – companies do this to transfer all the risk onto the worker and to reduce NI costs etc. Not really viable.

There’s a key point you’re missing, though. Most people on benefits are working! Only 1 in 8 benefit claimants is unemployed – the rest are hard-working people who have to claim housing benefits, income support etc because they’re paid so poorly.

If the government wants to get people off benefits, they should do this by enforcing a living minimum wage – make it better to be working than on benefits by increasing wages rather than reducing benefits. This would also take a burden off tax-payers – we’re currently subsidising corporate profits by having to top up income for low earners.

Thanks for the comment!

Hi Robert. Getting £26k in benefits is much harder that you think. Expect more like £9k, including housing benefit on a moderate rent. It is possible to live on this. but not in luxury,

And in order to get it you have to go through a deeply humiliating assessment of your capacity to work by an officious stranger who is probably not qualified to judge. Don’t believe the hype is it much harder to cheat on benefits than to cheat on text. And it is far less profitable that the DWP press releases (which have dominated the news from day one of this government. Sometimes they put out 2 or 3 a week attacking people on benefits, and most news outlets just reprinted them – though some did their homework and caught DWP telling fibs.

It’s sobering to see just how well the conservative propaganda has worked, but poor and sick people did not cause this crisis, and are not the big problem we have. Weak politicians and rapacious banks. caused the problem. As Skywalker1964 has pointed out there are a large number of people looking for jobs etc. The best way to deal with high welfare costs is create growth and jobs. Something that both Labour and now the ConDems have singularly failed to do.

Fantastic post – great response!

Robert you seem to have bought into the Daily Mail style narative that everyone on benefits could get a job tomorrow if they wanted to. Other replies here make excellent points, I’d just like to add that most of the jobs I see advertised in my local newspaper require considerable experience and qualifications, eg managing care homes, CAD designers etc. Many long term unemployed are not in a position to apply for them. As others have said, many of the ‘vacancies’ are not proper jobs and many are already filled but not taken off the database; the jobcentre pad out the system so they don’t expose how pitifully few real jobs there are. You really won’t get 26K on the dole but you’re welcome to try, until you do please don’t repeat such fabrications. I know that there are ‘cheats’ reported every week as conning thousands out of the system but there are many more desperate people wondering how to make ends meet. I know some of them personally, including several who are very ill and have been told they are ‘fit to work’.

Thanks very much for this, you’ve laid out the figures very clearly so that even a virtual economic illiterate like myself can see this scam for what it is. I completely agree with Jane James’ post – I’m a recent graduate and the jobs on offer are either those I could have done before my course or require training or experience that I’m unlikely to have if all of the entry level jobs in those sectors are unavailable. A further point to make is the lack of investment in training supplied by employers which is now either seen as the responsibility of the state or of the individual, the latter being less likely if you’re living hand to mouth and can’t afford the expense of often rudimentary and pointless qualifications. The state seems to be run entirely for the benefit of business and damn the human cost.

Great comment. This post has attracted some fantastic ones!

It’s hard to respond without sounding callous, but I don’t understand what you were expecting. You’ve spent several years educating yourself and now you find the skills and knowledge you have acquired are not in demand by employers. That must be disheartening, but surely you had a view as to what you planned to do with your qualifications once you had earned them? Has the market changed since you began your degree?

You make the point that individuals can often not afford the expense of “often rudimentary and pointless qualifications”, by which you mean things that will get you a job. However, you’ve just finished several years of an expensive qualification which by your own admission has been of no benefit in getting you a job.

Is this not simply a case of you making the wrong choice in how to improve yourself?

I appreciate this does indeed sound heartless, I’m just not a good enough writer to ask the questions in a more sympathetic way.

Steve, playing with the chart tool at ukpublicspending, I got this. Note that the pension numbers are zero before 1993, and it rather looks as pension expenditure was including in the welfare numbers before that. If that’s correct, your chart of the “welfare” series is highly misleading.

Thank you – that’s a very interesting graph. However, I don’t think it impacts materially on the points I drew from the information overall.

That piece about Barclays ‘1% tax’ you link to is, I’m afraid, nothing but a shocking example of financial illiteracy amongst UK journalists. Errors included comparing tax paid in the UK to profits earned globally, failing to understand that a large proportion of the profits came from a business disposal which, due to tax law explicitly and deliberately enacted by parliament (a Labour one, at that) was NOT taxable, and also entirely failing to grasp the rather simple concept of ofsetting prior year losses against tax (because, as we all know, the banks did make some rather large losses prior to 2009). It’s possible (though I confess I don’t remember if it was ever firmly established) that the writer of that article even managed to confuse the amount of tax physically paid *in* a year with the amount due to be paid *for* a year… because, you see, corporate tax is (and can only be) paid in arrears.

So it’s cute of you to refer to all the ‘accounting tricks’ that corporations have to reduce their profits and their tax rates.. but when you throw such a discredited piece as that out there as support it does, rather, show that you’re basing your view on suspicion and half-truths, rather than any genuine understanding of the issue.

It’s not that you’re especially wrong… companies will usually seek to lower their tax charge where they are able.. but if there is a problem to be addressed, then it’s counterproductive for the debate to be led by people who don’t understand what’s actually happening. It would serve your ’cause’ well for pieces like that Guardian Barclays article to be allowed to fade away from memory.

Thanks for your comments. I have a decent grasp of the facts – and of what goes on within businesses. I’m far from saying that previous Labour governments didn’t contribute to the situation – but the next one should do something to correct it.

Offsetting previous years’ losses against current profits is a massive ‘trick’. Private individuals aren’t allowed to reduce their current year tax bill because last year they were unemployed etc. I’m not even especially blaming companies for exploiting loopholes – but the loopholes must be closed. They’re a major part of our real structural problems.

As for the rest of your Barclays points, if Barclays paid tax on their foreign operations’ profits in the country of those operations, that’s one thing. If they accounted profits from UK operations deliberately against entities in lower-tax countries in order to reduce their tax bill – which they do, as I recall – then that’s a different thing altogether. Again, a structural issue – close the loophole. Without question, Barclays and other corporations will be doing everything they can to avoid tax. It’s good for shareholders in the short term – and bad for the country in short, long and medium terms. So it’s a structural problem – and needs to be changed.

Tellingly, even you have to admit I’m not ‘particularly’ wrong. A different spin on a particular case doesn’t change the overall truth – the swing away from wages toward rich individuals and big companies has damaged the Treasury’s tax take and is the real reason why social spending appears unaffordable. Cutting that spending is clearly the wrong solution.

Thanks for your comments, though.

In the year in question, Barclays had taxable profits of £4.6bn, and a tax charge of £1.1bn.. an effective rate of 24%. Not, you will note, 1%. That fact (which is very easily identified by taking a few seconds to look at the accounts) is, alone, enough to entirely discredit the writer of the Guardian article. She was either willfully misrepresenting what happened, or deeply incompetent. But, I do agree, one bad example doesn’t necessarily invalidate an argument.. albeit that most of the most popular examples of this sort of thing (Barclays, Vodafone, Phillip Green) don’t stand up very well to informed analysis. That’s a shame.. because it’s easy for those in power to resist making shutting off the genuine abusive practices if those practices are not the ones getting all the press.

Offsetting losses isn’t a ‘loophole’ or a ‘trick’.. it’s a fundamental part of tax law all over the world. The comparison with us mere individuals is bogus.. we don’t earn negative income when we are unemployed, and the costs we bear (living and such like) are not tax deductible whether we work or not. I could, however, point out that the welfare system that helps us out when we’re unemployed could, very well, be deemed analogous to the tax relief for companies who have made losses and, what’s more, is paid regardless of whether we subsequently go back to work, whereas companies have to make future profits in order to get *their* ‘welfare’.

Anyhow.. whilst there’s been an increase in the share of national income going to profit, there’s been a much bigger increase in the share going to government, so I’m not quite sure your conclusion that the profit share is the reason for restricted government spending entirely holds up. I would also highlight that the beneficiaries of the majority of the increase in profits are the private pension funds who hold all the shares.. so a good proportion of that increase does, at least, flow back into the pockets of us mortals.

That’s my 2p’s worth. Or is it 4p now? Anyhow, thanks for engaging. My desire is not to pick one side or another in this kind of debate.. but rather to see the debate held from positions of genuine understanding on both sides. There’s nothing to be gained by us all squabbling around half-truths whilst the vested interest in business and politics carry on as they always have done.

Actually a self-employed individual can offset prior year losses carried against current year profits.

There is so much wrong here that I hardly know where to start. Perhaps with your confusing Bevan with Attlee who based his policies upon the report by Beveridge (OK the names start with the same three letters)? Bevan’s NHS just took over the charity hospitals but his stuffing the RCS mouth with gold pushed up costs so much that the Labour government sound it could not afford everything it had promised and Gaitskell had to introduce charges on teeth and spectacles. So your whole argument is based on a false assumption. It’s more wrong than just teeth and spectacles Bevan himself said that the great thing about the National insurance Fund was that there was no fund – it was a government Ponzi scheme used to cover part of their deficit because the welfare state cost more than Dalton, Cripps and Gaitskell could collect in taxes

The second false assumption is that we now have a comparable Welfare State to Attlee’s which provided War Widows with an extra 10s per week (if you’re under 50 that is 50p). NHS spending is more than ten times in “real” (inflation-adjusted) terms; pension age has not risen in line with life expectancy or, more appropriately, years of healthy life; modern social housing is luxurious compared to the prefabs built in the ’40s, housing benefit costs a mint but that wasn’t necessary in the 40s because private sector rents were still frozen at World war I levels(mostly less than £1 a week); the cost of education has soared under New Labour while the standard of literacy and numeracy is lower than in 1950; ten times as many go to university where most of them get an impractical academic view on the work that their grandparents learned on the job.

Most of your charts are just wrong – even one of your friends points that out. An increase in income inequality under Thatcher did not, repeat not, result in an increase in poverty because the poorer half of society got richer, just more slowly than the richer – but your data is flawed because it uses taxable income rather than actual income and Geoffrey Howe increased tax receipts from surtax payers when he reduced the top rate of tax from 98% to 60%: tax avoidance slumped. Also the share of national wealth owned by the top 1% and top 5% decreased under every government since I started to read *except* New Labour where it increased – and the share of owned by the bottom 50% decreased to one-third of the level under Thatcher.

“there is no structural deficit” ROFL – except it isn’t funny.

I’m not mixing anyone up with anyone, thanks. I’m a little under 50, but I know what 10s was, too – although it was worth a heck of a lot more in those days than 50p.

‘Most’ of the graphs are wrong? Hardly, but never mind. A ‘friend’ (I don’t know him) pointed out something interesting about how pensions were accounted pre-1990, but it doesn’t change the overall point.

You touch on something right, in passing. Housing benefit costs are ridiculous EXACTLY because governments have allowed greedy landlords to push up rents far ahead of inflation or any other reasonable measure. Rather than capping/cutting housing benefit, rents should be capped – and freezing them wouldn’t be a bad idea, to deflate house prices and make them affordable again.

As for income inequality, the graph shows relative poverty, which is a key factor. Not only absolute poverty is damaging. The top earners outstripped the rest massively, ever since Thatcher – just as they did in the US ever since Reagan. It’s a systemic, structural wrong – and we shouldn’t be afraid to say so, or to want to change it. It continued under New Labour, and that’s something to be ashamed of – and to make sure isn’t repeated. But it’s ridiculoursly untrue to say it ‘slumped’ under Thatcher and Major – unless you’re only about 20 and learned to read late.

There is no structural deficit in terms of excessive public spending – only in terms of inadequate taxation and inadequate rigour in ensuring that profits are honestly stated for tax purposes.

Night, now!

The “structural deficit” about which Alastair Darling and just about everyone else using the term referred is is a BUDGET deficit. It describes the non-cyclical part of the shortfall between (central) government income and its spending. Darling’s budget deficit was £150 billion. HMRC estimate of the “Tax Gap” between what it collects and what it would collect is £35billion. The budget deficit was more than FOUR times the “Tax Gap”.

Part of this gap is down to the exemption of small businesses with turnover of less than £77,000 from the requirement to register for VAT. This exempts most self-employed tradesmen and is the largest single part of the VAT shortfall. Anyone who pretends that one can estimate the income and corporation tax shortfall by applying the VAT percentage is either woefully ignorant or intellectually dishonest. Since you allow comment I assume that you are honestly but mistakenly accepting a third party’s misinformation as if true.

I’m aware of what the deficit is. The term ‘structural’ is a red herring, though. *Of course* the state’s income is cyclical, because economies are. It’s ovine to chase that cycle with spending cuts, though – that would simply remove stability and make things worse.

Everyone in the media talks as if the only way to reduce the gap is to cut spending, but of course the government has the option of increasing taxes – and of changing the way those taxes are calculated to more correctly reflect profits and social need.

The govt could collect more based on its existing rules – but I also advocate a different and greatly simplified system for calculating profit and tax, and to have it done by state audit, not accountants who are incentivised to hide profit and minimise tax.

We might not actually be that far apart in how we view the existent situation – just very different in how we view potential solutions!

It is fashionable on the Left to decry the Laffer curve but unless you believe that people not only should but also will work for nothing you have to accept that it exists. I suggested to an advocate of higher taxes that he might work as a volunteer for a Charity and he immediately indignantly replied “I’m not going to work for nothing!”

So the question is where is the peak of the Laffer curve? I had hoped it would be above 50% but the overwhelming bulk of the evidence is that it is lower. Eliminating all the tax breaks created by Gordon Brown would help but not by enough. So the reason why there need to be cuts is that the government just cannot raise enough in tax on a sustainable basis (a wealth tax would work for one year or at most two before the take slumped) to cover the level of spending it inherited.

Absolute poverty is FAR more important than relative poverty if you are hungry or homeless or sick or in rags. Relative poverty is a clever device to mask the politics of envy behind a veneer of respectability. “Relative poverty” declined between 2008 and 2010 because most people got poorer but City pay dropped faster than the average – did that help any poor people – pull the other one.

Rents have gone up because there is a housing shortage – if there was a surplus landlords would not be able to push rents up. There are many reasons for this but the decline in the quantity of Social Housing between 1997 and 2010 plays a part and so does the extension of Lloyd George’s temporary rent controls during WWI until the 1950s, making being a responsible private landlord actually unprofitable (not just a low return on capital invested – a negative one) so building houses for private renting during downturns in the housebuilding cycle totally or virtually ceased. Once you’ve driven out most of the responsible private landlords and the rest have died off, you are left with the greedy or the accidental and while the existence of the latter pushes down rental levels, there aren’t ever going be enough of them.

If you want to find Barclays tax charge for 2009 you could try reading their report & accounts which even calculates the tax rate on continuing businesses for you (23% being £1.074bn divided by £4.585 billion). This is audited.

That assumes you trust auditors lol – they don’t exactly have a glowing track record.

Trust me, though, it’s on my list to do – but also to try to get a handle on how much of their profits were genuinely generated abroad and so legitimately taxed there, and how much was simply accounted as overseas earnings in order to pay tax at more favourable rates somewhere.

I’ve worked in enough businesses to be aware plenty of ‘dodges’ of this kind, with slick inter-co accounting etc to weight the figures in favour of more profit.

Of course, Barclays can afford to spend millions on accounting and still come out better off, and I’m just me. It’s probably going to be hard to find the tells – one reason I’d advocate state-based accounting/auditing.

The Big 4 audit firms are by no means perfect but they have a far better record than state-based audits. A tax rate of 23% doesn’t actually leave much room for hiding the odd billion in a tax haven, does it?

It’s nice that you’re such a big fan of ‘the state’ doing things like that. I presume you’re hoping that the same high standards that were applied to things like banking regulation will be applied to state auditing? And that the state auditors will be entirely immune to corruption and coercion, much like the politicians we would elect to appoint and guide them?

Of course the state isn’t immune. But it’s the most likely option for a fairer solution. It’s human nature that businesses and the rich will try to get away with whatever they can – and be very creative about it. Governments – at least in democracies – can be held to account.

Funny you should mention banking regulation. If anything was a clear demonstration that corporate interests have become far too powerful, it’s that. The state needs to take back power and make business march to its tune, rather than the other way round.

Off to bed. Sleep tight.. 🙂

This is a fascinating post but it feels like a post of two halves. I get the first bit about debt and public spending and the second bit about inequality. What I didn’t see, unless I’m missing something, is the link between the two.

If unequal incomes have reduced the tax as a percentage of GDP then I can see how changing that would help to solve the affordability problem but, as far as I’m aware, tax to GDP has been pretty constant. Unless taxes go up or spending is cut, therefore, the increasing debt to GDP level isn’t solved.

Unless I missed a link somewhere.

The link between the two is that it’s the ever-increasing concentration of income and wealth in the hands of people who pay little tax on it that is the real reason for the budget deficit – that’s our ‘structural deficit’ problem.

But if that were true, wouldn’t the tax take as a percentage of GDP have fallen significantly? It’s true that it has fluctuated and it fell in the 80s after a steep rise in the late 70s, but it’s now about where it was in 1978.

It’s a lower rate of tax on a hugely increased portion of GDP, so there’s an offsetting effect. There’s also an under-reporting of profits/income by companies and the rich, which distorts the position and would increase GDP if it was properly counted – tax avoidance tricks etc make it appear lower than it is.

Very enlightening. Thank you.

Also, pretty depressing. But you knew that.