It happened again, in Prime Minister’s Questions, today. It was bound to, really. Rebuked by the excellent Speaker of the House, John Bercow, for using insulting, unparliamentary language toward Shadow Chancellor Ed Balls, David Cameron fell back, like an involuntary reflex, on a mantra I can guarantee you will hear in at least 99% of Tory (and most LibDem) interviews on TV or radio, in the press or online.

Withdrawing his comment as instructed, Cameron said:

“I will replace it with ‘the man who left us this enormous deficit and this financial crisis’.”

And, of course, cue much Tory guffawing and catcalling of the type that only a £25k a year private education can teach.

This (mostly) Tory tactic has been in place since before they were elected, and has continued, unbroken and to the point of nausea, to the present. Listen to any interview, any ‘debate’ on Newsnight or Question Time (though the Tories like to avoid debate if they can!), and you’ll hear some variation of:

‘the mess we inherited’

‘we’re having to clean up Labour’s mess’

and so on. Clearly, in order to try to get off the hook of the never-ending run of screw-ups, the Tory PR gurus have drummed this into their politicians until they eat, sleep and breathe ‘inherited mess, inherited mess, inherited mess…’

The only tiny problem with all this is this: it’s absolutely untrue.

I’m going to try to show you why. It’s not really that difficult to see, but a lot of people don’t look beyond the mantras and the headlines. Anyone who knows me very well will know that I talk a lot about the ‘Big Lie’ concept. In a nutshell, this says that the bigger a lie is, and the more emphatically it’s spouted, the more people are likely to think, ‘Well, they wouldn’t dare say it, and especially not like that, if it weren’t true!’ But of course, it isn’t true – that’s the whole point. As someone said to me the other day, a plausible lie, shouted loud enough and often enough, usually gets to be taken for the truth.’

Since a picture paints a thousand words and all that, I’m going to use a couple of graphs to illustrate just how untrue this Tory Big Lie is, along with a little commentary. There may be ‘lies, damn lies and statistics’, but when it comes to nailing a Big Lie, a few objective numbers work wonders.

The ‘inherited mess’ lie has 2 main parts. The first says that the economic crisis was caused by Labour’s overspending. The second says that the resulting ‘mountain’ of government debt led to such an economic disaster that Dave, George and co had to come galloping in on their big chargers to rescue us with their Magic Sword of Austerity and Competence to clean up the mess and fix our economy.

Let’s nail each part of the lie in turn. First, was Labour overspending, and was government debt drastically increasing under Labour? Well, the IMF (see www.scoop.it/t/deficit-myth) say not, and even George Osborne himself, under pressure from Treasury Select Committee members, has to admit it ain’t so (see www.youtube.com/watch?v=BK-h4aiuGIs). Now, on to those pictures:

Graph 1

This handy graph shows the changes in UK national debt since 1999 (2 years after Labour came to power). It shows something very interesting. In the years from 1999-2002, the UK’s national debt SHRANK to the lowest point it has been since well before Labour took over, right through to the present day. In fact, although not shown on this graph, the debt when Labour took power – the ‘inherited mess’ from the previous Tory government! – was higher than at any time during Labour’s tenure until the 2008 global crash.

From 2002, the graph shows a gradual, managed increase, over a period of 6 years, from about 29% to about 35%. This is the period when Labour – as they had promised to do – started to increase investment in great, beloved British institutions like the NHS, as well as in other public services. This gradual increase was no problem – it was controlled, deliberate, affordable. And it was still lower than it had been under the preceding Tory government.

Of course, in 2008, something drastic happened. There was a global financial crisis that hit virtually every country in the world – hard. National debt increased – but, as the IMF report linked above confirms, this increase was NOT due to excessive public spending! National income fell, and this inevitably pushed up the amount of borrowing. But here’s another thing – without being in the same kind of sudden meltdown, the misguided austerity policies of the coalition government have kept the debt growth-line steep! That’s because those policies are shrinking the national income far further and faster than spending could or should ever be cut. The way out of the current problems is to stimulate growth – and that’s not compatible with austerity budget-slashing.

Here’s another graph that shows very clearly how Labour did not leave a mess behind for the coalition to clear up:

Graph 2:

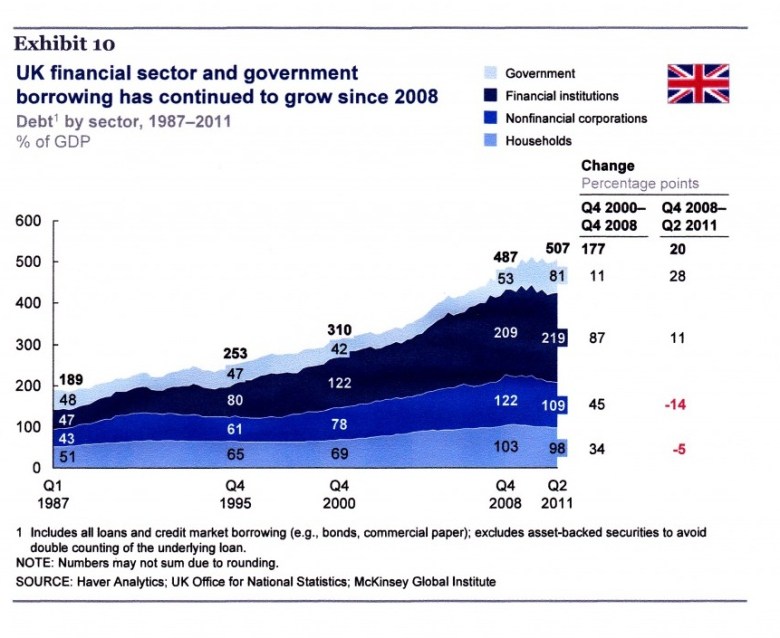

Now this one’s ever so slightly trickier to read, but bear with me. I want you to focus on the thickness of the very light blue block of the graph at the top. Don’t look at how high up it goes, as that’s caused by the thickness of the blocks underneath it.

This light-blue block represents UK government debt from 1987-mid 2011, as a percentage of GDP (basically, the amount the whole country earns). The striking thing about this light-blue block is that it hardly changes in thickness at all from 1987 all the way through to the big global financial crash in 2008 (in fact it gets a little thinner during most of Labour’s last period in government). The first 10 years of that period were under a Tory government. The next 11 were under Labour. If Labour were being profligate in their spending, so were the preceding Tory governments of Thatcher (Queen of Austerity!) and Major, and somewhat more so.

Of course, as already mentioned debt went up during and just after the 2008 crash, because national income went down. You can see the light-blue block thicken at this point. But Tory spending cuts, even without a global ‘meltdown’, are pushing debt up and making the debt-block fatter. Countries like the USA, who under Barack Obama took a positive approach to stimulate their economy, have experienced growth during the same period that we’ve increased debt and suffered recession. Unlike Labour, the Tories have no excuse for the increasing national debt under their (mis)management – so they invent one: ‘the mess we inherited‘, and repeat it for all they’re worth in the hope of fooling people into believing their Big Lie.

There are other things I could draw out of the 2nd graph, such as the fact that household debt and non-financial companies’ debt during the same period grew, but that far and away the big debt-increase problem, as the graph clearly shows, was irresponsible borrowing by financial companies (in other words, NOT the Labour government!), and that in spite of such companies clearly being the cause of our crisis, this Tory government is not curtailing the obscene bonuses the banks etc continue to pay themselves (I guess they need bonuses to console themselves for the destruction they caused!).

And there are other graphs worth looking at. But I think I’ve made my point and given you enough to chew on for now. So I’ll round off, for clarity’s sake, by reiterating the key point that all the graphs and words above are there to prove. Which is:

WHEN THIS GOVERNMENT AND ITS REPRESENTATIVES SAY ‘THE MESS WE INHERITED’ – AS THEY OH SO SURELY WILL – THEY ARE LYING: IT IS A ‘BIG (FAT!) LIE’!

They want to fool you, so they can continue wrecking our great country and siphoning our money into the pockets of the so-called elite who pay into Tory party coffers (and Tory ministers’ bank accounts, it appears).

Don’t let them.

Oh come off it, you still hear the left blaming Thatcher for all society’s ills and don’t forget that note from Liam Byrne.

The difference is, accusations against Thatcher are mostly TRUE, whereas the ‘inherited mess’ mantra is a convenient Big Lie. Byrne was foolish, but it was a tasteless joke. After all, the Tories had won by campaigning on the same lie they’re still parrotting…

The Thatcher government also used the “inherited mess” line if I remember correctly. The IMF loan had been paid off by 1979, yet the Tories were still talking about it.

Thatcher was to blame for one hell of a lot of problems.

Liam Byrne thought he was making a joke, but it fell flat as the tories haven’t got a smile between them, unless it’s to do with more money going into their accounts…

While I agree that Thatcher in the UK (and Regan in the US) set in motion a deliberate attempt to restructure society in a much more inegalitarian way, it has to be said that Liam Byrne was an idiot for leaving such a statement IN WRITING as a hostage to fortune, which the Tories and Libs could exploit whenever they wished.

His apparent stupidity does raise a question as to what exactly was in his mind when he did such a stupid thing?

Did he believe he would not get back into power and wanted to ensure Labour would not win any future general elections?

How else can his act be explained?

I think you’re mixing up Labour’s spending with ‘investment’. Capital infrastructure spending was done via PFI and is ‘off balance sheet’, and financed at rates the Tory’s ‘mates’ would never get under the Tories ‘ironically’.

The introduction of tuition fees has also placed an entire generation in indentured servitude at the same time as higher taxes, higher asset (house) prices and a huge demographic time-bomb all start to go go off. It’s impossible to save and invest for yourself and your family because their’s NOTHING left at the end of the month.

Spending on additional doctors, nurses, medical treatments, police etc isn’t ‘capital infrastructure’. As for tuition fees, I’d agree. Nobody’s claiming Labour is or has been perfect. But Labour’s swinging left again, as it should.

Not that I’m saying everything the coalition is doing is correct, but your interpretation of the graphs is flawed.

They are showing the level of borrowing as a percentage of GDP. To utilise one of your arguements; GDP has dropped because of a global recession, so even if no more money was borrowed the percentage would increase as GDP dropped.

If you were to have a graph of actual borrowing in £ and maybe one showing the value of GDP there could be less room for misinterpretation.

I said in the blog post that the graph shows debt (not borrowing – that’s the same mistake that Chloe Smith made on Newsnight the other night) as a percentage of GDP. The point remains correct: Labour were no worse – in fact were rather better – in terms of national debt relative to income than the Tory governments that preceded them. The 2008 global crash worsened debt, but would have done that no matter who was in charge. In the current ‘crisis’, countries that invested in stimulus, like the US, are still growing. So the current coalition government doesn’t have the same excuse that Labour did. The ConDems are worsening the UK economy because of reckless, ill-considered policies that are strangling spending power and confidence.

Brilliant. As we’re fortunate enough to have you as a member of ‘Cutting Edge’, would you please consider posting this (or something very similar) on a thread on our UK Economics board? Thanks.

http://cuttingedge2.forumotion.co.uk/f20-uk-economics

Hi Ivan,

Done!

The mess Labour left behind had nothing to do with government debt – it is that they allowed the de-regulation of the financial sector, pumping an asset price bubble. We could have used regulation to push the extra borrowing into productive industry, rather than fanning a completely unproductive house price boom.

The Tories wouldn’t have done anything different though.

The deregulation really started way before Labour got into power, with Thatcher. I agree I’d like to have seen Labour reign the sector back in, but I’m not sure it would have been politically possible at a time when everyone felt it was going well. Now, who knows? I live in hope…

I don’t find it’s an acceptable to keep blaming Maggie. She was a turning point, but so was Blair. Labour had such popular support, they could have done pretty much anything in the first term, but chose not to.

I’m not a particular fan of Blair, or of Brown. But the truth remains that they presided over a prolonged period of growth and actually reduced the debt/GDP ratio until the global crash came – and they can’t really be blamed for that. Except the Tories do blame them – and then Cameron & Osborne use the Eurozone situation as an excuse for their poor performance.

I’m not a particular fan of Blair, or of Brown. But the truth remains that they presided over a prolonged period of growth and actually reduced the debt/GDP ratio until the global crash came – and they can’t really be blamed for that. Except the Tories do blame them – and then Cameron & Osborne use the Eurozone situation as an excuse for their poor performance.

As for being acceptable, it’s not the right question – it’s simply true that Thatcher stripped away all the controls, in partnership with her boyfriend Reagan.

Debt to GDP grew massively, as you show in graph 2. New Labour took a cowardly way out – allowing the credit bubble to develop and private debts to soar without any policy response whatsoever. Never any mention of the countries persistent trade deficits and our increasing reliance on foreign cash inflows to finance our borrowing. The government could have stopped all this from happening, and it did nothing.

It wasn’t Thatcher who gave the Bank Of England it’s mandate to target CPI 2%. It was Gordon Brown. This was the crucial factor which allowed the credit bubble as most debt creation in this country is facilitated through mortgage “lending”, and house prices are completely absent from CPI.

New Labour definitely left a mess, but the Condems are dishonest about the causes. They are all liars, but that is to be expected when you will never win an election by giving it to people straight.

Debt/GDP ratio only shot up at the 2008 crash, which is what my post says. Up to that point it remained lower than it had been under the Major govt.

At the crash, debt/GDP naturally shot up – but because of the crash, not ‘recklessness’. And it’s continued as steeply and even more under the coalition, who don’t have a crash as an excuse.

no, private debt has been soaring throughout the new labour reign. That is not something a government should ignore, or else the inevitable consequence is a balance sheet recession, and the inevitable increase in government debt. People were warning about this as early as 2003 but the government chose to ignore it.

Actually, if you look at the graph showing debt in various sectors, the rise in private debt is moderate – the real, uncontrolled rise is in financial sector debt. The ability of the private sector to leverage debt like that predates the Labour government by a long way.

If you consider increases of 65% and 100% over 13 years to be moderate, I’m sure you wouldn’t mind if your personal income or wealth fell by a similar amount.

Moderate by comparison with that of the financial sector. Personal borrowing will have been fuelled by increases in house prices leading to massive increases in mortgage borrowing. A very bad thing – but not really a sign of any kind of Labour mismanagement.

How is it nothing to do with the Labour, when they set up the conditions required for massive increases in all categories of debt?

I mistakenly started commenting because I thought you might have some intelligent thought processes going on, but you seem to be just another die-hard Red Team supporter.

How did Labour do that? I’m genuinely interested, but I’m not going to just accept your comments unless you substantiate them!

Primarily, by removing house prices from monetary policy, but additionally by not building new social housing or changing planning policy to allow more building, and by not regulating the financial institutions. They had years and years to do this!!

I would agree with you on that. Nobody’s saying New Labour were perfect – especially me! But getting that wrong doesn’t mean they left behind a mess the Tories need to clear up. Blair et al didn’t correct the situation created by Thatcher’s ‘right to buy’, so it’s an omission rather than something they created.

Anyway, if I were just a ‘red-team supporter’ interested in propagating an entrenched position, I needn’t have approved your initial comments to appear on the blog 🙂

Can you please remind me how many times Gordon Brown said there would be no more ‘boom and bust’? And do you accept that this was a big lie of Labour?

I have no idea, but it was too many. I don’t think it was a big lie, though – he was just overconfident and wrong, given the insane foundation of hypercapitalism our economy’s been built on for the last 30-odd years.

@Ariel Adam

“I don’t find it’s an acceptable to keep blaming Maggie. She was a turning point, but so was Blair. Labour had such popular support, they could have done pretty much anything in the first term, but chose not to”

I do. She destroyed this country’s manufacturing base in order to smash the unions. Where I come from that’s referred to as “cutting off one’s nose to spite one’s face”. Blair’s Nu Labour was little different to Thatcher’s Tories.

It’s obviously not just politicians that use statistics to manipulate their own truths. The IMF figures are at best external gathered and contentious. To prove the point here’s alternative figures from UK sources. (http://static.guim.co.uk/sys-images/Guardian/Pix/pictures/2012/3/21/1332345654504/UK-deficit-graphic-008.jpg) The reality is that even a 25% to 35% increase in percentage annual debt that is admitted and is claimed as planned and affordable is reckless. It was borrowing an ever increasing amount in the vain and totally unplanned hope we’d be able to pay it back in the future. Curiously we are ignoring Brown’s decision not to regulate the banks more tightly in order not to stifle their world competitive edge and the fact Gordon sold off the very gold reserves which could have given us a lifeline in this time of need. It was widely accepted he sold at the worst possible time. If anyone wants to argue it wasn’t a mess before the economic crises they should be left alone to live in their own world where mental gymnastics will allow any result you like to be presented as truth.

The graphic you yourself pointed to shows a Labour government with generally better fiscal management than the Tories that preceded it – not dissimilar to Major’s just before it, but a little less.

Also, you mention a 25-25% increase in debt, but that’s not what the graph shows. It depicts annual borrowing, i.e. the deficit or surplus in a given year, not the total debt.

Labour’s deficit was controlled, and increased intentionally for specific purposes – and then was reducing until the worldwide financial crisis. But since, according to you, this puts me in my own world, enjoy it in yours!

Oh, and you should bear in mind that a major cheerleader for ‘Brown’s’ banking deregulation was… David Cameron.

The graphic you yourself pointed to shows a Labour government with generally better fiscal management than the Tories that preceded it – not dissimilar to Major’s just before it, but a little less.

Also, you mention a 25-25% increase in debt, but that’s not what the graph shows. It depicts annual borrowing, i.e. the deficit or surplus in a given year, not the total debt.

Labour’s deficit was controlled, and increased intentionally for specific purposes – and then was reducing until the worldwide financial crisis. But since, according to you, this puts me in my own world, enjoy it in yours!

Oh, and you should bear in mind that a major cheerleader for ‘Brown’s’ banking deregulation was… David Cameron. In fact, DC felt it didn’t go far enough.

New Labour followed Thatcher’s ideology, that’s the reason why we have the problems we do now, it’s been 30 years of neo-liberal bullshit, now the tories/libdems are forcing even more of it on us.

As for not blaming Maggie and it all being Brown’s fault, here’s Cameron claiming credit on behalf of previous tory governments for the deregulated financial sector.

“Here is Mr Cameron in June 2006, offering his thoughts on ‘the new global economy’. He trumpeted ‘the victory of capitalism, privatisation and liberalisation’. Not to be out-grovelled by Gordon Brown when talking about bankers, the Tory leader lauded the ‘highly innovative’ City as ‘the biggest international finance centre in the world’. Mr Cameron happily noted that ‘there are more than 550 international banks and 170 global securities houses in London’, numbers that may now be subject to downward revision. The Cameron of this pre-bust vintage gave the credit for all that reckless – sorry, ‘innovative’ – trading to ‘critical Conservative decisions’ when the Tories were in government. It proved that ‘light regulation’ and ‘low regulation’ were ‘keys to success’.

Just over a year ago, in September 2007, Mr Cameron made a speech at the London School Of Economics. The financial markets were already experiencing what was then politely termed ‘turbulence’, but the Tory leader chose to amplify his thesis about the ascendancy of unconstrained capitalism. In a section entitled ‘The End Of Economic History?’, he answered the question by declaring that: ‘The debate is now settled.’ ‘Liberalism’ had prevailed. The left’s silly idea that markets required tight regulation had been thoroughly discredited. ‘The result? The world economy more stable than for a generation.’ He drizzled sycophancy on the heads of the bankers, drooling that ‘our hugely sophisticated financial markets match funds with ideas better than ever before’. What a pity the casino got so sophisticated that it traded trillions of dollars of toxic bets that no one understood, including the gamblers themselves.”

http://www.guardian.co.uk/commentisfree/2008/oct/19/gordonbrown-davidcameron-economic-policy

And Robert Jenkins from the Bank of England seems pretty clear about who he thought caused the financial crisis.

“As financial panic spread I watched in disbelief as bankers trooped through the doors of Downing St to advise government on how best to address a problem that they (the bankers) had created”

http://www.bankofengland.co.uk/publications/Documents/speeches/2012/speech603_foreword.pdf

It’s been an absolute disgrace how they’ve been allowed to turn a private sector mess into the public sectors fault, public spending wasn’t the problem, still isn’t the problem, and no matter how much spin they use that fact will not change for anyone with an ounce of sense.

If you have the balls ( !) – please look at this clip to see how utterly deluded you are :

http://www.fsponline-recommends.co.uk/page.aspx?u=eobvid2&tc=LMYKNC16&PromotionID=2147068535&

It’s a fact that Labour took a 350 billion national debt, and doubled it by 2009. That 350 billion debt took 300 years to reach the 350 billion level ! Socialists have no idea how to create wealth – merely how to bribe the electorate by ‘ investing ‘ a euphemism for borrowing.

I’ve already answered these points the last time you raised them as a comment on my ‘about me’ page. After 6 years of Labour government the debt was actually lower than when Labour took over, as you yourself pointed out. It then grew moderately as part of a planned programme of investments based on a strong economy. The ‘doubling’ (though it didn’t actually double – £347bn x 2 = £694bn, not £600bn – your own figure) took place primarily as a result of the combination of emergency funding of the banking system and the drop in revenue that followed the crash.

The banks – run by all those nice, true-blue chappies – caused the debt problem, not Labour and not overspending. And your point (the first time you raised this in the comments) that it may reach £1.5 TRILLION by 2015 also damns the right-wing approach to economics. The increase since 2010 has been down to the Tory-led coalition’s complete failure (and perhaps lack of intention, since crises are useful for state-dismantling) to reverse the catastrophic effects of the misdeeds of the banks and corporations. Far from reversing or even arresting them, they’ve exacerbated them by their self-evidently idiotic ‘austerity’.

Thank you so much for this. I’ve looked for proof of this as being fact one way or another as its always been a show-stopper in my discussions with tory friends. Though logically it didnt make sense as it would just be the UK having the crisis and not the world economy. Thanks again.

Reblogged this on stewilko's Blog and commented:

Disgusting awful lies from brainwashing government. I really dispise this disgusting government. Their constent lies blaming the previous Labour government. All this time bleeding the heart and soul from this country. Destroying our welfare system, witch hunting the unemployed, disabled and many others. Lives lost because of undue pressure and stress. Finances taken away from from families, forced to go begging to foodbanks. The loss of hundreds of thousands selling of our national assets like our postal service. I really do hope that this labour party get their act together, be reflective and view the mistakes of this shameful, disgusting and evil coalition government. Bring austerity and hope to the British people, from the bottom up.

Reblogged this on The SKWAWKBOX Blog and commented:

Ken Clarke and other now ex-ministers, interviewed following their ‘reshuffling’ in David Cameron’s desperate attempt to show he’s doing something, anything, fell back as usual on the outright lie that they’re supporting the government’s efforts to undo the ‘economic mess’ left by the last Labour government. This lie has been repeated so many times that it has become ‘received wisdom’ in spite of the fact that it is patent nonsense.

So please read and share this post that I’m reblogging. It desperately needs to percolate into the public consciousness.

Reblogged this on Vox Political and commented:

This was reblogged with the following message from its author, Steve Walker: “Ken Clarke and other now ex-ministers, interviewed following their ‘reshuffling’ in David Cameron’s desperate attempt to show he’s doing something, anything, fell back as usual on the outright lie that they’re supporting the government’s efforts to undo the ‘economic mess’ left by the last Labour government. This lie has been repeated so many times that it has become ‘received wisdom’ in spite of the fact that it is patent nonsense. So please read and share this post that I’m reblogging. It desperately needs to percolate into the public consciousness.”

Those of us who take the slightest interest have known this for years.

Your graph above shows just how much the banks were in the hole and I can recall Gordon Brown bringing senior bankers and politicians together and banging their heads till it hurt and they agreed to bale out the private banking sector at public expense to avoid another 1930s-style scenario engulfing the world.

Balls, Miliband and others among the leading ranks of the Labour Party know this too so why have they chosen not to rebut the Tory lie?

Is it that they believe they will win the next general election regardless as to anything the Tories or Libs say and that they want to use the same excuse to buttress their own austerity policies after 2015?

I see peoples arguing over these figures but remember I no liked tony blair brown to me buggered the dentist ups but being one of that 99percent who aint rich then there isn’t no other party than labour for you yes you can vote tory but then that’s being a pratt but all in all I never argue over figures has they all bend them fix them to how good or bad they are look you got ossie and carney fiddling their books how right is that nah even with tb gb I never liked or cared for it was never this bad under them jeff3

Congratulations! you have captured your own sludge of Tory Trolls.

I have followed your blogs for years & made a few comments. But here you have a concerted effort you rubbish your figures. Big mistake on their part.

The whole of the tory rhetoric in every debate and especially the one on the welfare reforms with the whole of !DS’s speech about the labour mess just shows how hollow their rhetoric is. Yet labour struggle to repudiate it and come off looking very feeble.

Quite disgusting after 4 years all they can come up with is “It’s the mess labour left.”

Pathetic but time people woke up.

x

Reblogged this on amnesiaclinic and commented:

Very useful. Time to put this myth to bed for good!

xx

Reblogged this on Beastrabban’s Weblog and commented:

The Skwawkbox presents the graphs and statistics showing that the national debt did not increase much under Labour, and when it did, it was carefully controlled. The massive increase in the national debt has instead been created by the government’s austerity programme, and the global financial crisis, which was far beyond Labour’s control. In short, he shows that the Tories’ insistence that they are clearing up Labour’s mess is a lie, and a lie repeated often enough, becomes the truth.

Reblogged this on SMILING CARCASS'S TWO-PENNETH.

Reblogged this on sdbast.

I’m not an ideologist in political terms, so I do not call myself ‘Tory’ or any other label, however I do believe that Western states are inefficient, and are ludicrously wasteful of taxpayer’s money – I like to think of myself as a realist. I recommend that you read Dominic Frisby’s superb ‘ Life After The State’ to see why I think this way.

In terms of Labour’s record whilst in power, in my opinion debt as a percentage of GDP is misleading, as governments which fail to stimulate manufacturing and innovation so as to stimulate exports

( thereby creating a positive balance of payments – the true measure of whether a country is paying its way in the world ) instead artificially stoke up domestic demand. This is caused principally by increasing the money supply, which happens every time banks create new mortgages or loans, thereby creating a domestic credit boom which artificially boosts GDP growth. The money supply in the UK has increased by about 67 times since the early 1970s ( meaning you literally have 67 times as much money chasing roughly the same number of assets ) This is the real reason for the enormous house price inflation during that period.

If you look at a graph of the M4 money supply, it was about 3/4 of a trillion pounds when Labour came to power, and just over 2 trillion when they left power – so they nearly trebled the money supply. Funny isn’t it – house prices also magically trebled during that period. By the way, the single biggest cost of living expense for most people is their mortgage or rent. What did a trebling of house prices do to those costs? What effect has this had for younger people now locked out of the housing market, and having to pay exorbitant rents ?

Therefore I prefer to look at real UK government spending to show the true picture. If you look at graphs you can see that between about 1990 to 2000 UK governments spent an average of about 420 billion Pounds per annually, and for the first few years Labour did reduce spending to as low as 338 billion, so for several years until 2001 the national debt ( which was about 350 billion Pounds when Labour came to power ) fell slightly.

From 2002 onwards however, real spending increased sharply, so that in 2006/7 (please note – just before the crisis ) it was 552 billion per annum. This is why the national debt was about 900 billion by the time Labour left power – more than a 150% increase in just 13 years. Furthermore, consumer debt had risen from 450 Billion Pounds in 1997 to 1.3 trillion Pounds in 2010 – an increase which reflects the trebling of the M4 money supply. This is the harsh reality of where the magical GDP growth came from between 1997 to 2007….which is easier for a government – to increase the money supply, or to put in place an environment whereby the UK can balance its balance of payments and start competing and paying for its way in the world economy ? Labour went for the former.

By the way, whilst the Coalition has failed to reduce spending by anything like as much as it should have done, it is hard to turn an oil tanker quickly. The massive hike in welfare spending for example in the Labour years cannot be reversed in just a year or two. The fact is that whichever party is in power, the UK government spends far beyond the means of what the country can afford. Hence the solvency of the UK state now depends on foreign investors agreeing to carry on rolling over the enormous 1.5 trillion national debt as gilts mature.

By the way, the UK government after ‘ savage cuts ‘ currently spends about 740 billion GBP annually.

I forgot to mention how Labour tripled the private ( ie the loans and mortgages provided by banks ) part of the M4 money supply during their time in power.

A century ago banks had a capital ratio of about 20%, meaning that they had to hold capital in reserves of 20p for every £1 which they leant out. This ratio decreased gradually over many decades, but from 1997 to 2007 it decreased very sharply indeed, to the extent that RBS and Northern Rock had capital reserves of 2.5 to 3% of what they were lending out. If 2.5 % to 3% of the debts went bad then the banks would become insolvent. This reality is far removed from the standard Labour mantra that ‘the financial crisis washed up on our shores from abroad.’

All this explains the trebling of the M4 money supply, the trebling of house prices and the trebling of household debt between 1997 and 1997. I’m afraid that GBP growth in those years was done the dishonest way- by stimulating consumption based on debt, thereby creating the illusion of prosperity through house inflation. The harder way would have been to increase GDP by trying to be competitive with the rest of the world – investing in R&D, SMEs, technology, science and machinery so as to improve our balance of payments through exports in the manner that Germany has done. Instead between 1997 and 2007 we decided to back a consumer credit bubble and the tax revenues provided by the financial services sector in the City.

“All this explains the trebling of the M4 money supply, the trebling of house prices and the trebling of household debt between 1997 and 1997” should have been ‘ 1997 and 2007.